$37B Later, Enterprise AI Is Officially Business-Critical

Good morning,

This week we’re tracking where enterprise AI dollars are really going, how productivity is being reinvested, and what the TIME cover reveal says about AI’s power class.

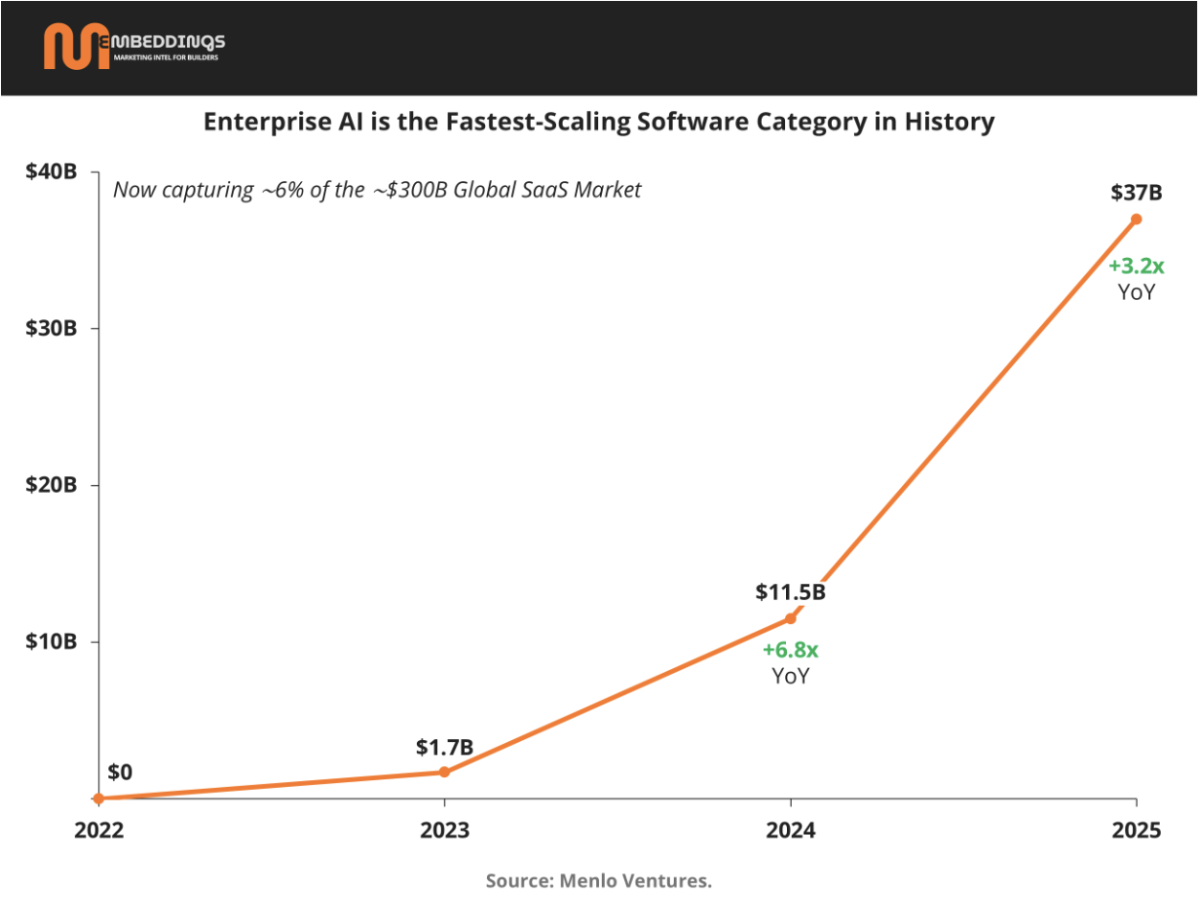

First up: enterprise AI spend is exploding, from $1.7B in 2023 to $37B in 2025, but it’s not chasing hype. In Big Picture, we break down how budgets are shifting decisively toward user-facing tools and day-one productivity, not speculative infra bets. This isn’t a bubble. It’s business.

Also in this issue:

McDonald’s pulls an AI-made ad after backlash

TIME names the “Architects of AI” its 2025 Person of the Year

Shopify rolls out Sidekick, its AI automation tool

And scientists invent a skin patch for texting by touch (yes, really)

In What Works, we explore why AI productivity isn’t killing jobs, it’s funding the next growth wave. Smart teams aren’t just saving time; they’re using the gains to scale capability, trust, and experimentation.

This issue is all signal. No fluff.

- The Marketing Embeddings Team

NEWS

McDonald’s has taken down a Christmas ad that was allegedly entirely produced with artificial intelligence after the brand was slammed with an onslaught of backlash from unhappy customers. (Read More)

Shopify Sidekick is the latest AI powered tool provided by the Saas company that helps in workflow automation for businesses (Read More)

TIME Magazine named“the architects of AI” as its 2025 Person of the Year, spotlighting leaders Jensen Huang, Sam Altman, Dario Amodei (Read More)

Scientists invent skin patch that allows humans to text by tapping their skin: The soft, skin-like patch uses iontronic sensors to detect pressing patterns and vibration modules to send tactile feedback, encoding all 128 ASCII characters purely through physical sensation. For anyone who's fumbled with their phone while driving or wished they could text without breaking eye contact, this breakthrough potentially opens up avenues into genuine hands-free communication (Read More)

NY State Governor Kathy Hochul passed two pieces of legislation on Thursday that forces certain productions to disclose the use of AI-generated performers, and defines rules around how someone's likeness can be used after their death. (Read more)

BIG PICTURE

Follow the Money: Where Do Enterprise Dollars Flow?

For all the noise about an AI bubble, enterprise spending tells a far more grounded story. This is not speculative capital chasing demos—it is operating budget flowing into production software at unprecedented speed.

Enterprise AI spending has exploded from $1.7B in 2023 to $37B in 2025, a 3.2× year-over-year increase, making it the fastest-scaling software category in history. In just three years, generative AI has grown to represent ~6% of the entire global SaaS market.

This matters for marketers because it signals something fundamental: AI is no longer an “innovation line item.” It is becoming core infrastructure for how companies sell, build, operate, and compete.

But the more important question isn’t how fast the market is growing—it’s where the dollars are actually going.

Applications Win: Productivity Over Promise

The clearest signal from enterprise budgets is this: companies are prioritizing immediate, user-facing value over long-term infrastructure bets.

In 2025:

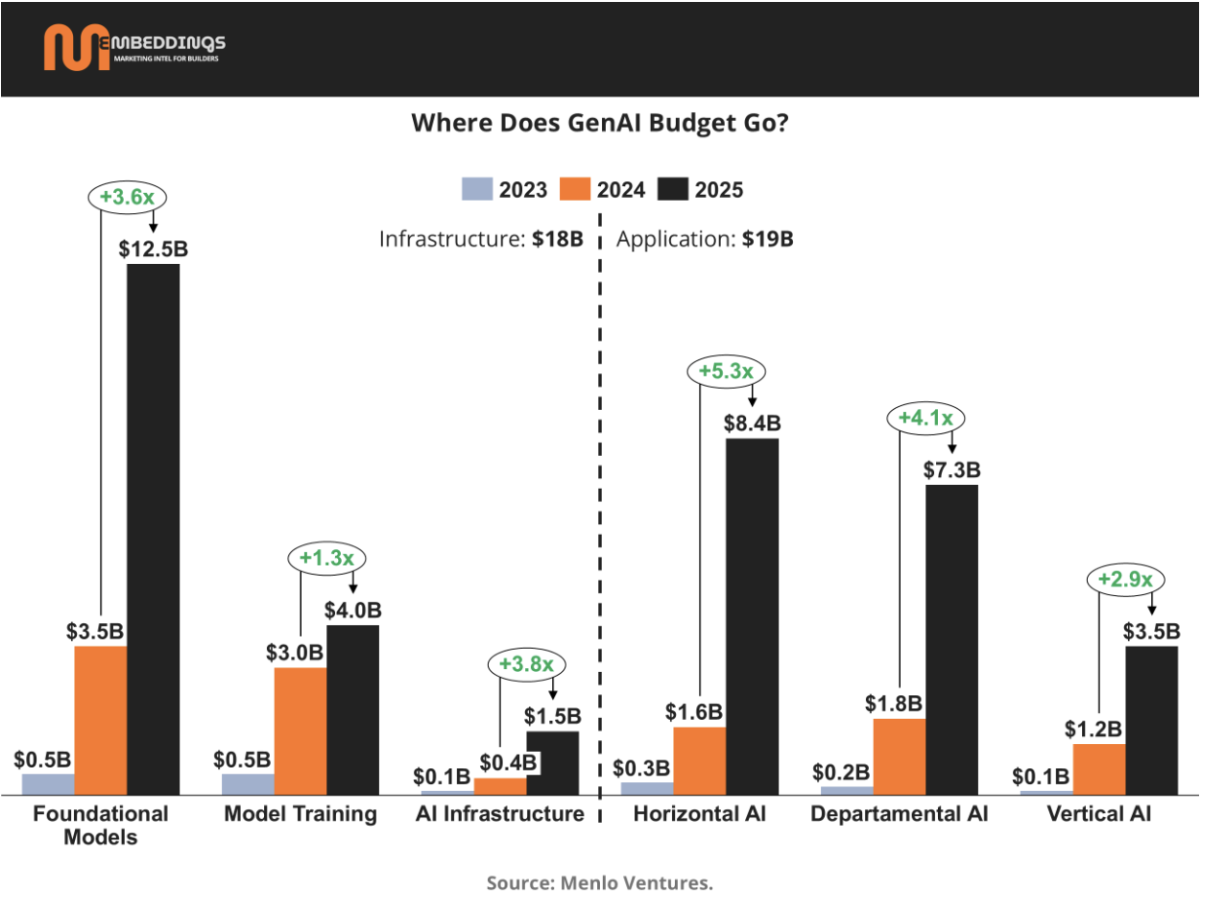

$19B (over 50%) of enterprise AI spend went to applications

$18B went to infrastructure, including model APIs, training, and data layers

This split is decisive. Enterprises are not waiting for perfect architectures or fully autonomous agents. They are buying tools that ship productivity now—copilots, departmental workflows, and vertical-specific software that plugs directly into day-to-day work.

Within the application layer:

Horizontal AI ($8.4B) dominates, led by copilots like ChatGPT Enterprise, Microsoft Copilot, and Claude for Work.

Departmental AI ($7.3B) is scaling rapidly, with coding alone representing more than half of spend—AI’s first true “killer use case.”

Vertical AI ($3.5B) is emerging fast, led by healthcare, where administrative automation delivers immediate ROI.

For marketing leaders, this explains why AI-native tools are proliferating so quickly across sales, marketing ops, content, customer support, and RevOps. Budgets are flowing to software that compresses time-to-output, not platforms that require multi-year internal build cycles.

The Bottom Line

Despite headlines warning of over-investment, enterprise behavior is remarkably rational. Money follows value, and right now value is being created closest to the user.

Enterprises are buying more than building

Applications capture the majority of spend

Productivity gains—not hype—are driving budgets

This is what a real platform shift looks like. Not a bubble inflated by belief, but a market expanding because AI is already paying for itself.

WHAT WORKS

AI Productivity Isn’t Killing Jobs, It’s Funding the Next Growth Wave

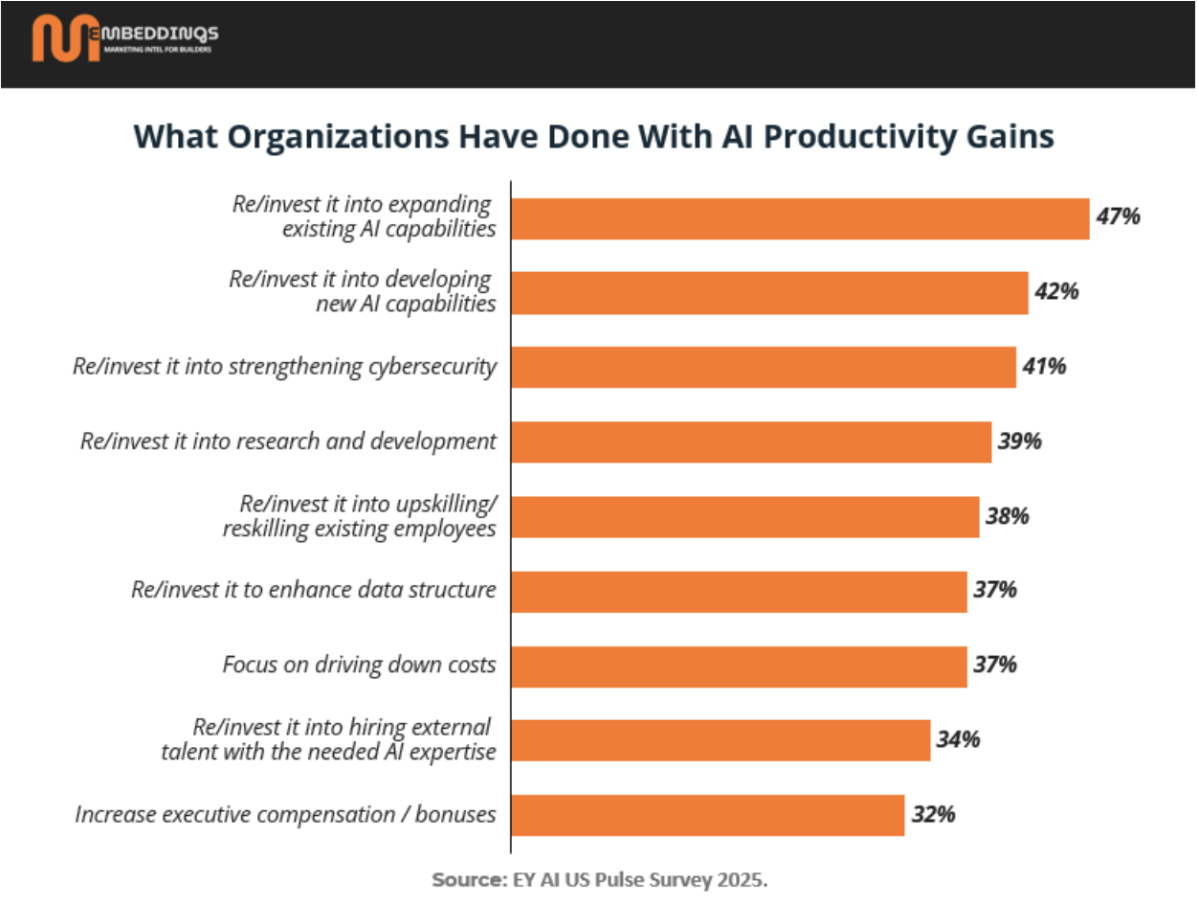

For months, headlines have framed AI productivity as a zero-sum game: more efficiency, fewer jobs. The latest EY US AI Pulse Survey tells a more nuanced — and more optimistic — story. Yes, AI is driving meaningful productivity gains. But most organizations aren’t cashing those gains in through workforce reductions. Instead, they’re reinvesting them to fuel growth, resilience, and long-term competitive advantage.

According to EY’s survey of 500 senior U.S. decision-makers, 96% of organizations investing in AI are seeing productivity improvements, with 57% reporting significant gains. Yet only 17% say those gains have translated into reduced headcount. Far more are plowing value back into their businesses — expanding existing AI capabilities (47%), developing new ones (42%), strengthening cybersecurity (41%), and investing in R&D (39%). Upskilling and reskilling employees also ranks high at 38%.

For marketers, this is an important signal. AI’s biggest impact isn’t just doing the same work faster — it’s enabling new capabilities. Teams that treat AI purely as a cost-efficiency tool risk missing the upside. The organizations pulling ahead are using productivity gains to experiment more, invest deeper in data infrastructure, and build differentiated capabilities that competitors can’t easily copy.

The financial momentum reinforces this shift. More than half of leaders who’ve seen positive AI ROI report significant improvements in overall financial performance. As a result, AI budgets are expanding rapidly. Today, 27% of companies commit at least a quarter of their IT budgets to AI; next year, that number is expected to jump to 52%. Investment at scale matters: organizations spending $10 million or more on AI are far more likely to report significant productivity gains.

Just as critical is trust. EY’s data shows growing emphasis on responsible AI training, ethical operation, and transparency with customers. This matters deeply for marketing, where brand trust and customer relationships are fragile assets. AI that drives growth without governance can just as quickly erode credibility.

The takeaway for marketers is clear: AI productivity gains are not the endgame — they’re the fuel. The winners will be those who reinvest early gains into better capabilities, smarter teams, and trustworthy systems, turning efficiency into sustained market advantage rather than short-term savings.

Bottom line: AI works best when it enables more ambition and is operationalized into systems that scale.