The Quiet AI Power Shift No One’s Talking About

Good morning,

This week we’re covering a platform shift in advertising, a power shift in AI models, and growing cracks in the AI business model.

First up: LUMA thinks advertising is AI’s first real product-market fit—and they make a strong case. Backed by $120B+ in LLM funding and $250B/year in infra spend, the sector is set to become the proving ground for outcomes-based AI. In Strategy of the Week, we break down who wins, who loses, and what to watch.

Then in Big Picture: Chinese open-source models like Qwen and DeepSeek are outpacing U.S. rivals on downloads, speed, and cost. For early-stage builders, they’re not Plan B—they’re the new default. U.S. firms will have to respond.

Also in this issue:

Why agencies can’t monetize zero-click tools

TikTok’s experiment in AI transparency

OpenAI’s ballooning inference costs

And the surprising reason insurers won’t touch AI risk

It's a market-capture moment, and the stakes are rising fast.

- The Marketing Embeddings Team

NEWS

A New Mandate for Agency Partnerships

Agencies are racing to offer zero-click analysis tools, but monetizing them isn’t easy

Agencies are rapidly rolling out zero-click search analysis tools to help brands understand how AI search models portray them, but many struggle to monetize these products because the insights rarely lead to new actions beyond traditional brand and media strategies. Open in GPT

TikTok is letting users control how much AI content they see

TikTok is testing a new slider that lets users choose to see more or less AI-generated content in their feeds, supported by invisible watermarks to help the platform better detect AI-made videos. Open in GPT

Here's How Much OpenAI Spends On Inference and Its Revenue Share With Microsoft

Leaked documents suggest OpenAI’s real inference spending and revenues differ sharply from public reports, indicating far higher compute costs—over $12 billion since 2024—and implying that the company’s expenses may significantly outpace revenue, raising serious questions about the financial sustainability of frontier AI. Open in GPT

Three Platform Shifts Power AI Economy

Jensen Huang framed three simultaneous platform shifts: CPUs→GPUs, generative AI, and agentic/physical AI driving massive, compounding demand. Open in GPT.

AI is too risky to insure, say people whose job is insuring risk

Major insurers are moving to exclude AI-related liabilities from corporate coverage because they see modern AI systems as unpredictable, high-frequency, systemic risks capable of triggering thousands of simultaneous claims that the industry cannot absorb. Open in GPT

STRATEGY OF THE WEEK

A New Mandate for Agency Partnerships

Advertising Was Built for AI

AI isn’t the next marketing trend—it’s the new foundation.

That’s the thesis from LUMA’s latest presentation, AI + Advertising: A Disruption of Tectonic Proportions

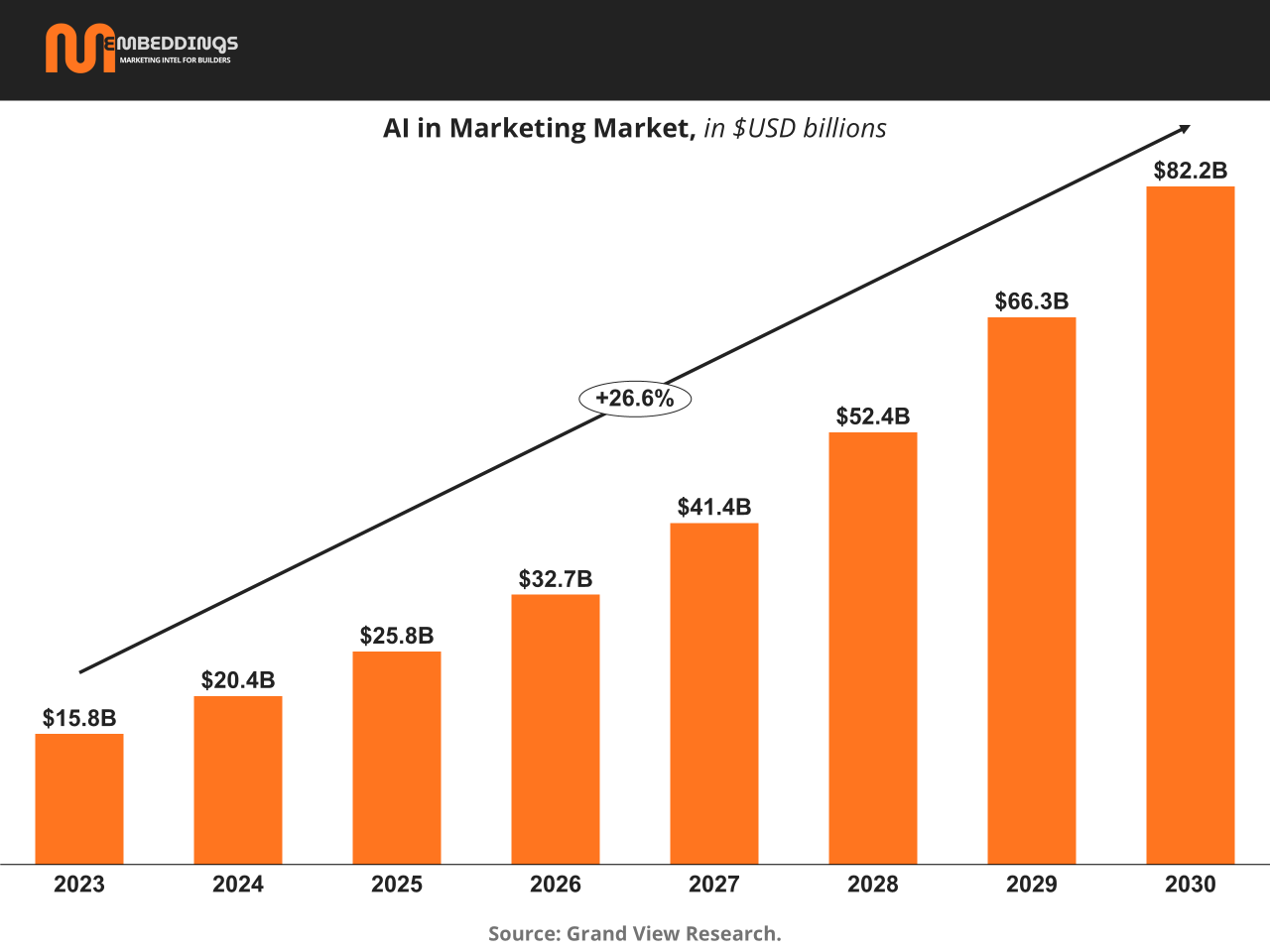

Backed by $120B+ in LLM funding and $250B/year in infra spend, this wave is too big to fail—and advertising is where the ROI will land first.

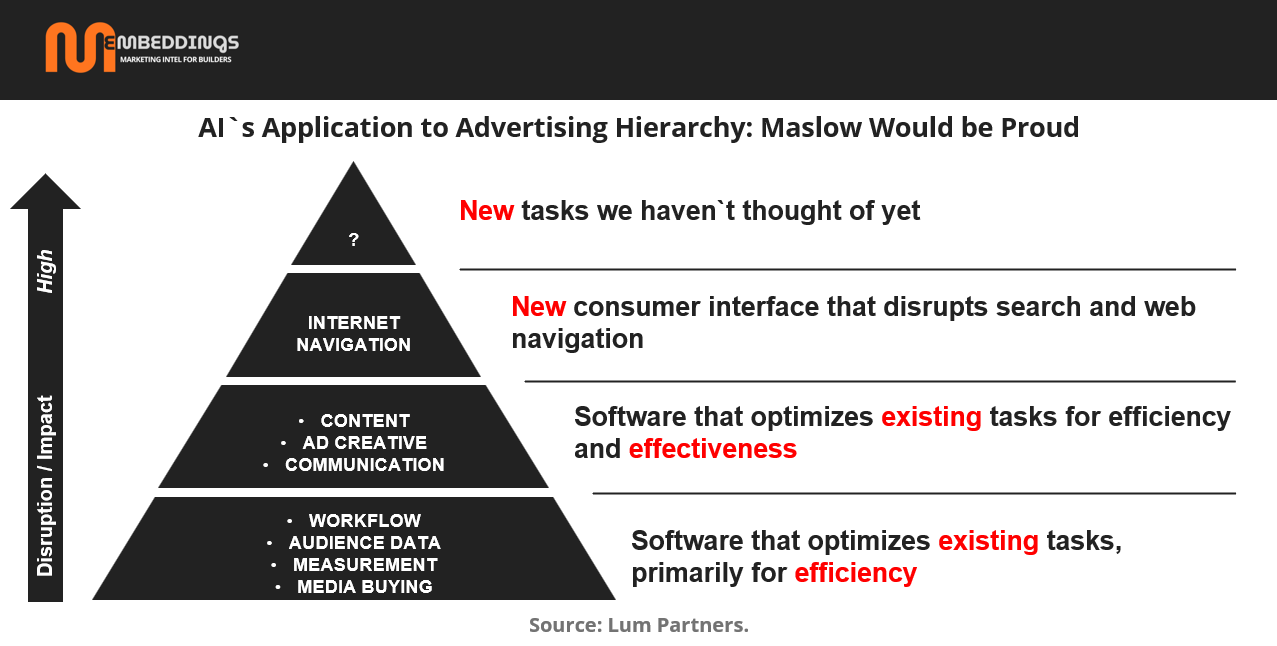

Why? AI thrives where there’s spend, data, and outcomes. LUMA frames it like a Maslow pyramid:

Base layer: AI supercharges workflows, measurement, and media buying.

Middle: Creative gets optimized via performance feedback loops.

Top: Search morphs into “answers,” delivering higher-intent signals than ever.

The implications vary by stakeholder:

Advertisers win big: AI lets them connect spend to outcomes, shifting advertising from discretionary line item to cost of goods sold.

Agencies and AdTech face a reckoning. Speed of adaptation—and inorganic growth—will determine survival.

Publishers? It’s a tale of two models. Aggregators and longtail sites lose to AI summarization. But domain experts and IP owners can win via licensing.

Bottom line: If LUMA is right, this isn’t just a new channel—it’s a new architecture. Strategy teams should benchmark AI efforts not just by tooling, but by whether they’re enabling an outcomes economy—one where attribution, automation, and advantage converge.

STRATEGY OF THE WEEK

The Rise of Chinese Open-Source AI Models

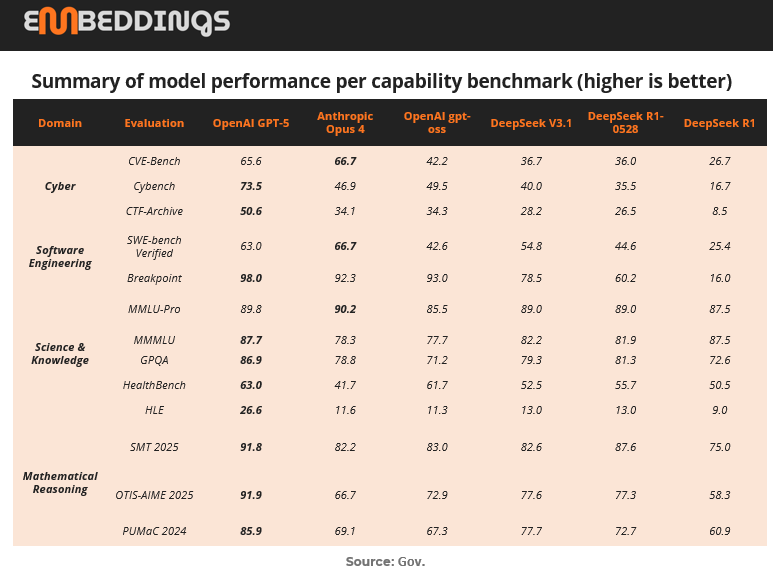

A growing wave of evidence from across the AI industry suggests that the center of gravity in AI innovation is shifting, and rapidly. Over the last 12 months, startups and even major U.S. companies have begun adopting Chinese open-source models like Alibaba’s Qwen, DeepSeek, Kimi, and GLM at a pace few expected.

Airbnb’s CEO recently revealed that the company has switched its customer service chatbot from OpenAI to Qwen because it is “fast and cheap.” On Hugging Face, four of the five most-used models today are Chinese, and by mid-2025, Chinese open models surpassed U.S. models in global downloads (550M vs 475M). For many developers, the primary drivers are undeniable: meaningful cost advantages, strong performance, and open-weight licenses that enable customization and self-hosting.

It’s hard to overstate how significant this shift is for builders. For early-stage companies operating with limited resources, Chinese models are not the budget option — they have become the default option, thanks to pricing that is 5–20× lower than U.S. commercial models and competitive benchmark performance.

Many startups are using open-weight models to train on proprietary data and deploy privately, bypassing closed-box APIs entirely. Venture investors report that as many as 80% of new AI startup pitches in 2024 are built on top of Chinese open-source models, and leading Silicon Valley dev tools like Cursor and SWE-1.5 are widely rumored to sit on Chinese foundations under the hood.